ARR (Annual Recurring Revenue) In SaaS: All You Need To Know

Updated June 2, 2024

Published July 26, 2023

The growth of your Software as a Service (SaaS) company depends on its ability to increase its Annual Recurring Revenue (ARR) year-on-year. Understanding how to calculate ARR will help you strategize for success. Keep reading to learn more about ARR and how it sheds light on the health of your SaaS business.

What is SaaS ARR?

ARR stands for Annual Recurring Revenue. It is a key number that measures how much money your software company can expect to make in subscriptions over the next 12 months.

Essentially,

Many software companies use a subscription model where customers pay monthly to use the software. ARR totals up those monthly subscription fees to give you a yearly number.

When calculating ARR, make sure you consider factors like customer churn, upsells to higher tiers, and downgrades to lower tiers to get a more accurate picture of your true recurring revenue.

ARR shows how financially stable your business is. If your ARR is growing, it usually means you are keeping customers and getting new ones.

ARR also helps set the value of your company if you want to sell it or get investors. It shows how well your business model works and how you might do financially in the future.

In short, ARR is very important for seeing how healthy your business is. It shows how predictable your revenue is and helps you make business decisions.

Knowing your ARR number lets you forecast earnings, track growth, and spot problems. It’s one of the most useful numbers for a software business.

How to Calculate Annual Recurring Revenue (ARR)?

It’s helpful to track your ARR over time, not just look at a single point in time. Seeing how your ARR changes month to month or year to year gives you important insights into the health of your SaaS business.

The basic formula for calculating ARR is simple: Add up the yearly contract value for all your active customers. For example, if a customer pays $2,400 annually for your software, that $2,400 would count towards your ARR.

Some revenue types don’t factor into ARR, like one-time setup fees or lifetime deals. You only want to include ongoing subscription revenue that repeats year after year. Anything less than a 1-year contract would also not be included.

Here’s a straightforward example: Suppose your software has 50 customers paying $200 annually. To calculate your ARR, you would take 50 customers multiplied by $200 per year. That gives you an ARR of $10,000.

It gets slightly more complex when customers pay monthly instead of yearly. Take a customer paying $100 per month. You’d multiply $100 by 12 months to get their annual payment of $1,200.

Your ARR will fluctuate as customers sign up, cancel, upgrade plans, downgrade plans, and so on. The goal is to see ARR growing steadily over time, indicating the health of your subscriptions. Monitoring ARR regularly is key to understanding the financial position of your SaaS.

In summary, ARR equals the total active annual contract value from subscriptions. Tracking it over time gives invaluable business insights. Update it monthly as your customer base evolves.

Why is ARR Important for SaaS Businesses?

There’s a significant relationship between SaaS ARR and business growth. A high ARR means higher total revenue, suggesting a stable and growing business. Conversely, a low or declining ARR signals there are issues you need to address.

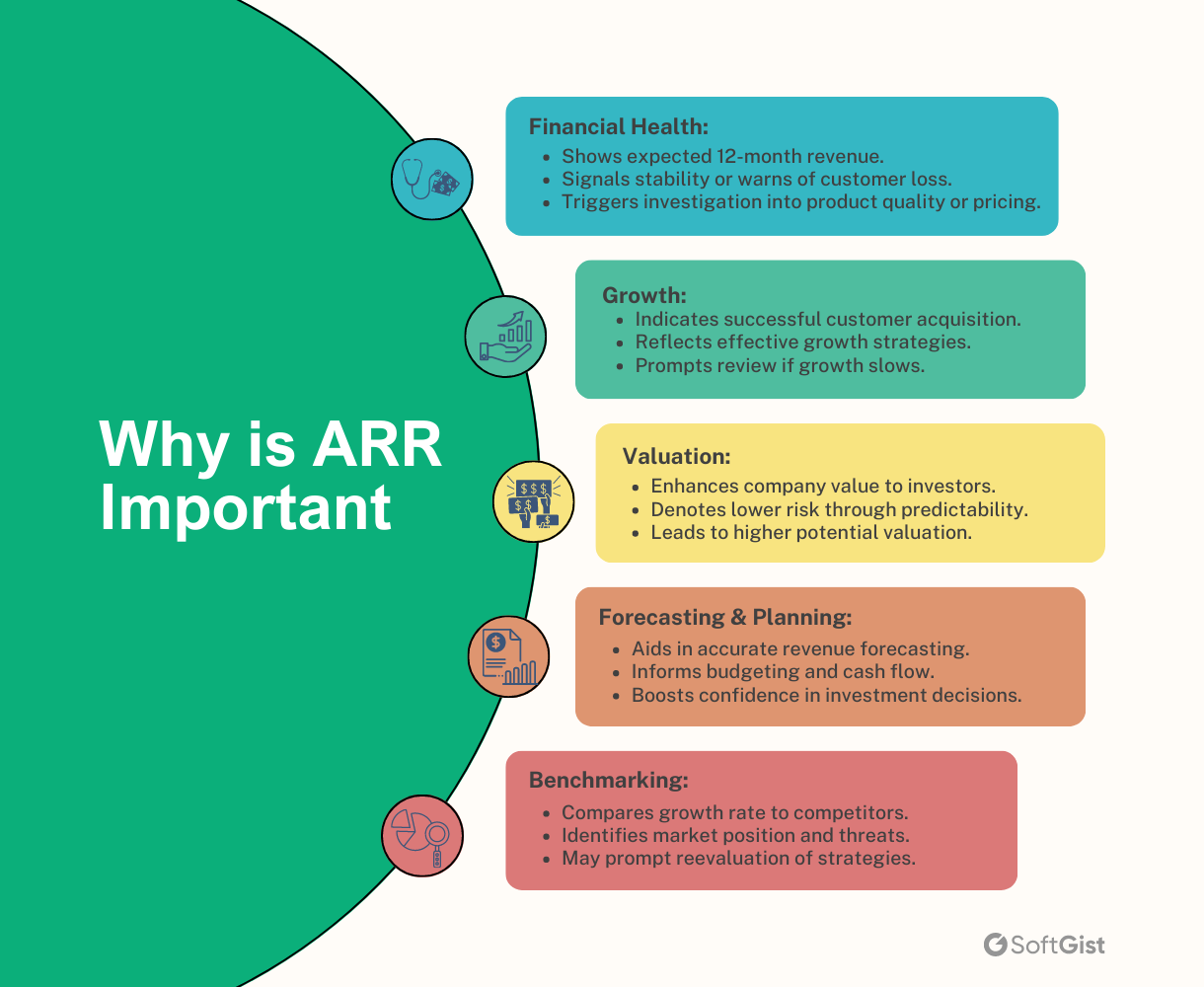

For SaaS companies, keeping a close eye on Annual Recurring Revenue (ARR) provides key insights into:

Financial Health

ARR shows the revenue SaaS companies can count on from existing customers over the next 12 months. Steady or growing ARR means financial stability from retained customers. But declining ARR is a warning sign that the business may lose customers. It means investigating issues like product quality, pricing, or customer support. ARR gives an early warning about potential problems.

Growth

Increasing ARR indicates a SaaS company is successfully gaining new customers and expanding purchases from existing ones. It shows growth strategies across marketing, sales, and customer success are working. But slowing ARR growth is a flag that customer acquisition and retention tactics need revisiting. Monitoring ARR identifies what’s fueling or hindering growth.

Valuation

Higher ARR makes a SaaS company more valuable to potential investors or acquirers. Predictable recurring revenue streams mean lower risk and higher rewards. Using ARR, valuations factor in a proven and scalable business model. Healthy ARR growth equals higher valuation potential.

Forecasting & Planning

ARR helps SaaS businesses accurately forecast revenue and expenses rather than guessing. Leadership can use ARR data to inform budgets, hiring plans, resource needs, and cash flow management. ARR-based forecasts create confidence in investment decisions.

Benchmarking

Comparing a company’s ARR growth rate to competitors shows its market position. Lagging could mean reevaluating target customers, pricing, product quality, or growth strategies. ARR benchmarking provides an objective view of opportunities and threats vs. rivals.

In summary, monitoring ARR provides vital insights into financial health, growth, valuation, planning, and market position. It empowers smart strategic decisions grounded in real data.

Differences Between ARR and MRR

The main difference between ARR and MRR lies in their timeframes. ARR provides an annual snapshot, while MRR offers more frequent, monthly insights.

Tracking both metrics is essential, as they offer different perspectives on your business. They paint a clearer picture of your company’s recurring revenue and future potential.

Here are several ways of how they differ:

Timeframe

ARR measures total expected revenue from subscriptions over a full year. It shows the big picture annual view. MRR only looks at revenue generated within one month, highlighting short-term monthly trends.

Calculation

ARR calculates annual revenue by summing the value of all customer subscriptions for the year while excluding one-time fees. MRR calculates monthly revenue by summing just one month’s subscriptions, again leaving out one-time fees.

Flexibility

ARR provides a long-term perspective useful for companies with annual or multi-year contracts. MRR better fits startups or companies with monthly subscriptions, as it tracks month-to-month evolvement.

Comparability

ARR is a valuation metric that helps assess the overall business health of investors. MRR is an operating metric managers use to monitor cash flow and operational efficiency.

In summary, ARR gives the big picture annual financial view while MRR shows granular monthly trends. To fully understand their finances, SaaS companies need to track both ARR and MRR. Together they provide the full perspective.

Other Key SaaS Metrics

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) provide valuable snapshots of subscription revenue. However, many other metrics complement ARR and MRR, offering a more detailed view of a SaaS business’s health and growth. These additional metrics provide unique insights that ARR alone cannot.

Customer Acquisition Cost (CAC): This measures how much it costs to acquire a new customer, including marketing and sales expenses. Comparing CAC to customer value shows if acquiring customers is cost-effective.

Customer Lifetime Value (LTV): LTV calculates how much revenue one customer generates over their entire relationship with the company. It demonstrates customer profitability over time.

Churn Rate: The churn rate shows how many customers cancel within a period. A lower churn indicates happier customers.

Annual Contract Value (ACV): ACV shows the average annual revenue per customer contract. It’s useful for varying contract lengths.

Average Revenue Per Account (ARPA): ARPA divides total revenue for a period by the number of customer accounts. It offers insights directly tied to ARR.

Specifically, tracking ARPA shows revenue patterns per customer. While ARR is a high-level view, ARPA is more detailed. It can reveal trends to help make decisions that boost ARR.

For example, a falling ARPA could mean losing accounts or downgrades. Understanding why leads to corrective actions like better retention offers.

In summary, complementary metrics like ARPA provide a deeper view than ARR alone. Together, they help SaaS companies gain insights to guide strategic decisions that support growth and improve ARR.

What is a Good ARR Growth for SaaS?

ARR growth is defined by:

The ideal ARR growth rate for a SaaS company depends on several factors. These include the company’s size, age, market, and industry.

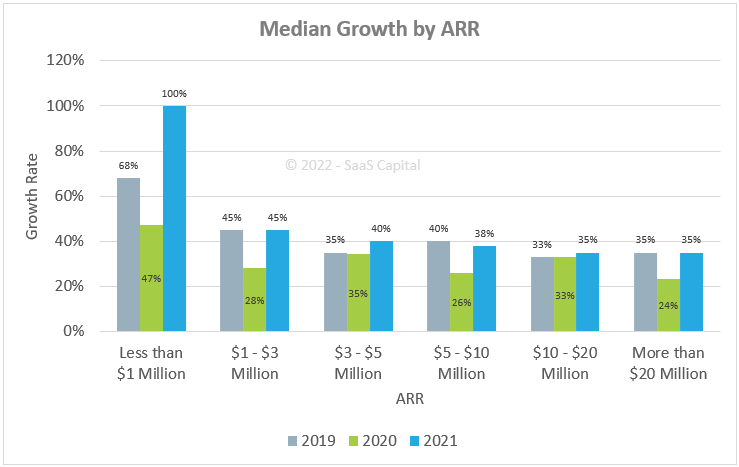

As a general guideline, many healthy SaaS companies target around 20-30% annual ARR growth. High-growth startups often exceed 100% yearly as they rapidly gain customers.

Bigger, more established SaaS companies may have lower rates. It gets harder to maintain high percentage growth as the revenue base gets larger.

According to research by SaaS Capital, in 2021, for SaaS companies with less than $1 million in ARR, the median growth rate was 100%. However, for more mature SaaS companies with $20 million in ARR, the median growth rate was 35%.

Growth should also be steady, not short spikes. Sustainable growth shows a sound business model and loyal customers. This leads to long-term success.

The ideal ARR growth rate varies by context. But targeting over 20% yearly is a good baseline for many SaaS companies. The focus should be on sustainable growth that proves a healthy, scalable business.

Tools for Tracking ARR

Tracking ARR is very important for subscription-based businesses to monitor their financial health and growth. Several software tools can make this easier and provide helpful information. Here are some popular options:

- Baremetrics – Easy-to-use tool made specifically for subscription businesses. Shows key metrics like Monthly Recurring Revenue and ARR. Has dashboards, reports, and forecasting.

- Sage Intacct – Comprehensive software for managing subscription revenue. Tracks MRR, ARR, Net Dollar Retention, cash flow, bookings, renewals, and more.

- ProfitWell – Free tool to track revenue, user growth, ARPU, MRR, ARR, User Retention Rate, and other metrics.

- Pabbly – Focuses on tracking Monthly Recurring Revenue and Churn. Helps understand these important metrics.

- Chartio – Helps calculate, visualize, and analyze MRR, ARR, and other revenue metrics. Provides insights into revenue trajectory.

Look for features like real-time data, forecasting, analytics, user-friendly design, and customer support based on your needs. These tools can track and analyze ARR to help make informed decisions and optimize growth.

Key Strategies for Growing ARR

Growing the Annual Recurring Revenue (ARR) of a SaaS business requires a multifaceted approach focused on both acquiring new customers and retaining existing ones. Here are eight key strategies to consider:

1. Customer Acquisition

Attracting new customers is essential for boosting ARR. First, identify and thoroughly understand your ideal customer profile so you can target the right audiences. Create a compelling value proposition that speaks directly to their needs. Utilize content marketing through blogs, ebooks, whitepapers etc. to educate and engage potential customers.

Leverage social media platforms and online advertising channels to increase awareness and reach more of your target audience. Promotional offers and free trials can help generate new leads. Ensure your sales and marketing teams are aligned and able to effectively convert leads to new customers.

2. Upselling and Cross-Selling

Maximizing the value of your existing customer base is crucial for growing ARR. Upselling involves encouraging customers to upgrade to higher tiers or expanded levels of your product or service. Cross-selling promotes add-on or complementary products, features and services that provide additional value.

For example, if you offer a CRM tool, you could upsell higher tiers with more features or cross-sell add-ons like email marketing, surveys or analytics. A structured customer success process is key to identifying upsell and cross-sell opportunities and conveying the additional value to customers.

3. Churn Reduction

Keeping customers longer directly impacts ARR, so minimizing churn is critical. Invest in excellent customer service and support to foster loyalty and satisfaction. Continually gather customer feedback to improve your product and ensure it evolves with their needs. Proactively communicate with customers and address issues or concerns quickly. Analyze common reasons for churn and develop strategies to combat them.

Churn reduction initiatives could also include better onboarding and training, expanded educational resources, incentives for renewals, or enhanced automation and self-service options.

4. Customer Success

Developing a robust customer success program ensures your customers can fully realize the value of your product, helping boost retention and expansion. Provide onboarding, training, and ongoing education on all features and capabilities. Conduct regular business reviews to understand their evolving needs. Identify ways to help customers achieve their goals and maximize ROI with your product. The more success customers have, the more likely they are to renew and expand their subscriptions.

5. Product Expansion

As your customers grow and their needs evolve, ensure your product expands to support them. Build scalable solutions that allow customers to increase usage, workflows, and team size without compromising performance or functionality. Offer appropriate pricing tiers and add-on packages. Seek direct customer input on enhancements that would provide the most value. Adding features most requested by customers can drive subscription upgrades and increases.

6. Strategic Pricing

Since pricing significantly impacts ARR, adopt a strategic approach. Select a pricing model aligned to the value customers gain from your product. Conduct periodic reviews of your pricing structure to ensure it still reflects the current market and the value your product delivers as both evolve over time. Monitor competitor pricing for benchmarks. Make data-driven adjustments to pricing that may increase ARR through higher subscriptions, expansion, or reduced churn.

7. Market Expansion

Expanding into new customer segments within your core market can bring in new customers to grow ARR. Research potential new segments thoroughly to understand their unique needs and pain points. Enhance or modify your product and messaging to resonate with each segment. Attracting new customer profiles to your product ultimately expands your total addressable market, leading to ARR growth.

8. Product Updates

Frequently enhancing your product keeps it compelling, secure, and relevant. Prioritize updates that address customer needs, fix bugs, improve performance, and add new capabilities. Gather direct customer feedback to inform your product roadmap. New features that deliver additional user value may support price increases. Updates drive customer satisfaction, retention, and expansion, ultimately contributing to higher lifetime value and ARR growth.

Final Thoughts

Annual Recurring Revenue is a vital compass for SaaS businesses. It provides data-driven insights to guide strategic decisions directly impacting growth and profitability.

Monitor ARR closely to spot opportunities to improve customer acquisition, retention, expansion, and pricing. Let ARR chart your course through market changes. Use it to steer toward sustainable success by attracting and keeping loyal customers long-term.

For SaaS companies, ARR is more than a metric. It’s an essential tool for data-backed strategy and vision. ARR gives unique foresight to help overcome challenges and seize opportunities. It enables smart decisions that drive competitive advantage.

In short, SaaS leaders should fully leverage ARR. Making it a priority leads to lasting success.

Share This Post

Alex Powell

Alex Powell is a senior tech and business media writer with a passion for breaking down complex tech topics into easy-to-understand information. He holds a degree in Business Administration and a master's in Journalism. When he's not writing, Alex enjoys hiking and reading books.

Allow cookies

This website uses cookies to enhance the user experience and for essential analytics purposes. By continuing to use the site, you agree to our use of cookies.