ARR vs. MRR in SaaS: Key Differences

Updated June 2, 2024

Published July 27, 2023

What are the key metrics that help SaaS companies unlock the power of recurring revenue? Two vital numbers provide valuable insights – Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR).

This article will explore what ARR and MRR are, their key differences, when each is most useful, and the challenges of managing them effectively. Understanding these metrics is crucial for SaaS businesses to harness the full potential of steady, predictable income from subscriptions.

The Power of Recurring Revenue for SaaS Businesses

Recurring revenue provides crucial benefits for software companies that offer products through subscriptions.

Recurring revenue refers to cash flow that repeats regularly, typically monthly or yearly. It comes primarily from customers continually renewing their subscriptions for the SaaS offering.

Key advantages for SaaS businesses:

- Better planning – Since future revenue is more certain, SaaS companies can confidently invest in growth.

- Enhanced valuation – Predictable revenue streams make SaaS companies more appealing to investors or acquirers.

- Improved cash flow – Steady income enables stability and continuing operations even when sales fluctuate.

- Increased customer loyalty – Subscriptions incentivize SaaS companies to keep customers satisfied long-term.

- Expanded market opportunities – Reliable revenue allows SaaS companies to develop products for new segments or regions confidently.

For SaaS companies, recurring revenue is generated primarily through customer subscriptions. Customers pay ongoing fees, usually monthly or yearly, for continued SaaS product or service access.

Other sources include:

- Support and maintenance fees that customers pay regularly.

- Additional fees for premium features or capabilities.

- Extra fees for more storage, more users, etc.

In summary, recurring subscription revenue offers crucial strategic benefits for SaaS companies. It provides a solid foundation for success and growth.

ARR and MRR: Key Metrics for SaaS Companies

SaaS companies rely heavily on bringing in recurring revenue from subscriptions month after month and year after year. Two important metrics help them track and forecast this revenue:

Annual Recurring Revenue (ARR) is the total amount of money a SaaS company can expect to get from subscriptions over the next 12 months based on their current customers. For example, if 100 customers pay $500 per year for a service, the ARR is $50,000.

Monthly Recurring Revenue (MRR) is the total recurring subscription revenue a SaaS company expects to get in the upcoming month from their current customers. For example, if 100 customers pay $50 monthly for a service, the MRR is $5,000.

ARR shows the bigger picture of revenue that can be counted annually. This helps with longer-term planning and goal setting. MRR zooms in on just the next month’s revenue. This helps with short-term planning and spotting quick opportunities for improvement.

Together, ARR and MRR help SaaS companies in several key ways:

- Forecast and budget better for the future

- Set realistic goals monthly and annually

- Identify ways to increase recurring revenue

- Evaluate their market position against competitors

- Spot threats and opportunities in revenue trends

ARR and MRR give SaaS companies crucial insights into the predictable money flowing in from subscriptions. Understanding these metrics leads to better data-driven decisions.

ARR vs. MRR: Key Differences

ARR and MRR are two key numbers that show how much steady subscription money software companies can expect. Let’s look at their key differences.

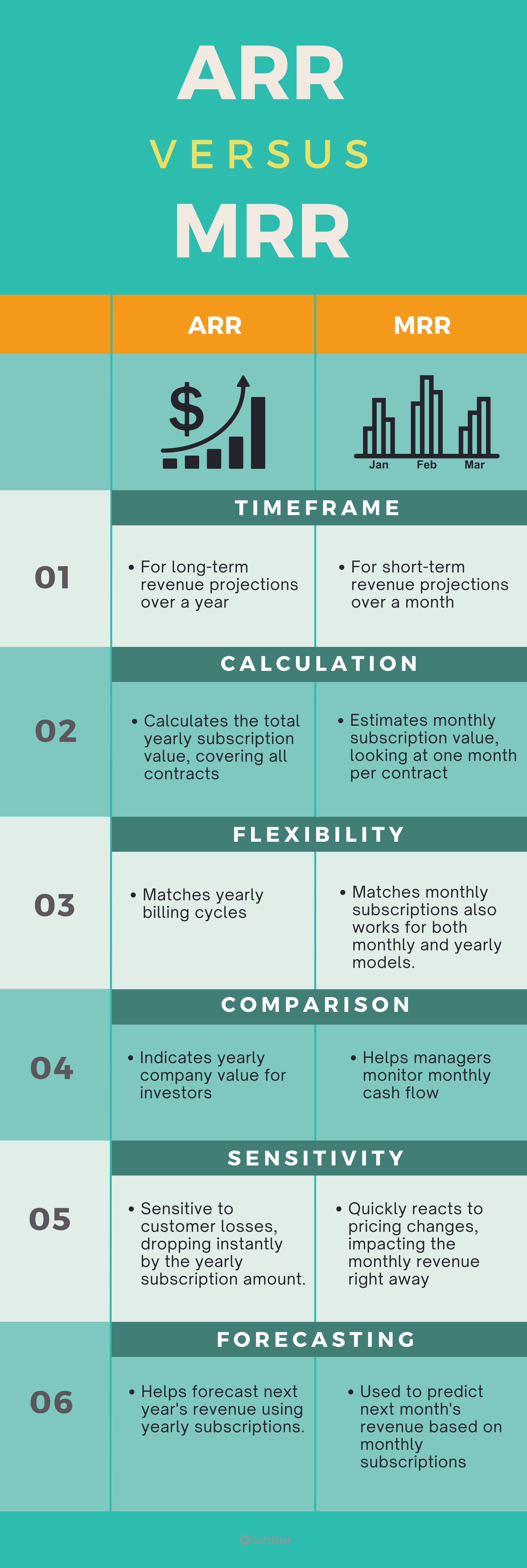

Timeframe

ARR shows the total subscription money expected over the next 12 months based on current customer deals. For example, if a software company has 100 customers, each paying $500 annually, its ARR would be $50,000 (100 * $500). This 12-month period gives a long view of the company’s possible revenue.

MRR, on the other hand, shows the total subscription money expected for the next month based on current customers. For instance, if a software company has 100 customers, each paying $50 monthly, their MRR would be $5,000 (100 * $50). This 1-month period provides a short view of the company’s revenue.

Calculation

ARR is calculated by adding up the yearly value of all active customer subscriptions, including the whole contract term. MRR, however, is calculated by adding up the monthly value of all active customer subscriptions, focusing on one month at a time.

Flexibility

ARR is especially good for companies with yearly or multi-year contracted billing cycles since it matches up with longer cycles well. MRR, however, fits better for companies with monthly subscriptions. It can also work for companies with a mix of monthly and yearly billing cycles, giving a quicker view of revenue.

Comparison

ARR serves as a valuation measurement, helping to assess the overall health of a business. Investors often use this yearly repeating revenue number to evaluate a company’s value. MRR, on the other hand, serves as an operational measurement, allowing managers to monitor cash flow and how efficiently things are running month-to-month.

Sensitivity

ARR tends to be more sensitive to customer churn. If customers cancel their subscriptions, ARR immediately drops by the full yearly amount lost. MRR, however, is more sensitive to pricing changes. Any increase or decrease in prices impacts MRR right away for that monthly billing cycle.

Forecasting

ARR allows for more accurate long-term revenue prediction for the next 12 months based on the full yearly subscriptions. MRR, on the other hand, allows for more accurate short-term revenue predictions for the upcoming month based on current monthly subscriptions.

When to Use ARR and MRR

ARR and MRR have different uses and are used in different situations, providing helpful views of a company’s money situation.

ARR is typically used for long-term planning and predicting, giving a full view of the company’s future revenue. Here are some times when ARR is really helpful:

- Long-Term Planning: ARR helps set yearly money goals and make strategic choices for the following year. It helps businesses understand their revenue trends year by year, enabling informed strategic decisions.

- Investor Relations: ARR is crucial for investors as it shows a snapshot of the company’s yearly repeating revenue. This is a strong sign of the company’s money health and long-term possibility, making it valuable for investor relations.

- Benchmarking: ARR can be used to compare the yearly performance of different software companies. It is a useful way to assess a business’s overall health compared to its competitors.

MRR, on the other hand, is typically used for short-term planning and performance tracking. Here are some times when MRR is really useful:

- Short-Term Planning: MRR helps set monthly money goals and make operational choices. It helps businesses understand their monthly revenue trends, allowing them to adjust their strategies accordingly.

- Cash Flow Management: MRR is key to understanding the company’s cash flow. It assists businesses in monitoring their monthly repeating revenue, enabling effective cash flow management.

- Performance Tracking: MRR can be used to track the business’s performance month-to-month. It serves as a useful way to identify trends in customer behavior, like churn rates and upsell rates.

ARR is best used for long-term planning and investor relations, while MRR is best used for short-term planning, cash flow management, and performance tracking. Both numbers are vital for software companies, offering different views on the company’s repeating revenue and future potential.

Here are some extra tips for using ARR and MRR:

- Regularly track both ARR and MRR to monitor your business’s performance over time and identify areas for improvement.

- Compare your ARR and MRR to other software companies in your industry to compare your performance.

- Use ARR and MRR to set money goals for your business, helping you stay on track and reach your growth goals.

By consistently tracking ARR and MRR, software companies can better understand their money health, enabling strategic choices that encourage business growth.

Challenges of Managing ARR and MRR

ARR (Yearly Repeating Revenue) and MRR (Monthly Repeating Revenue) are two important numbers for software companies. However, managing them can present some unique challenges.

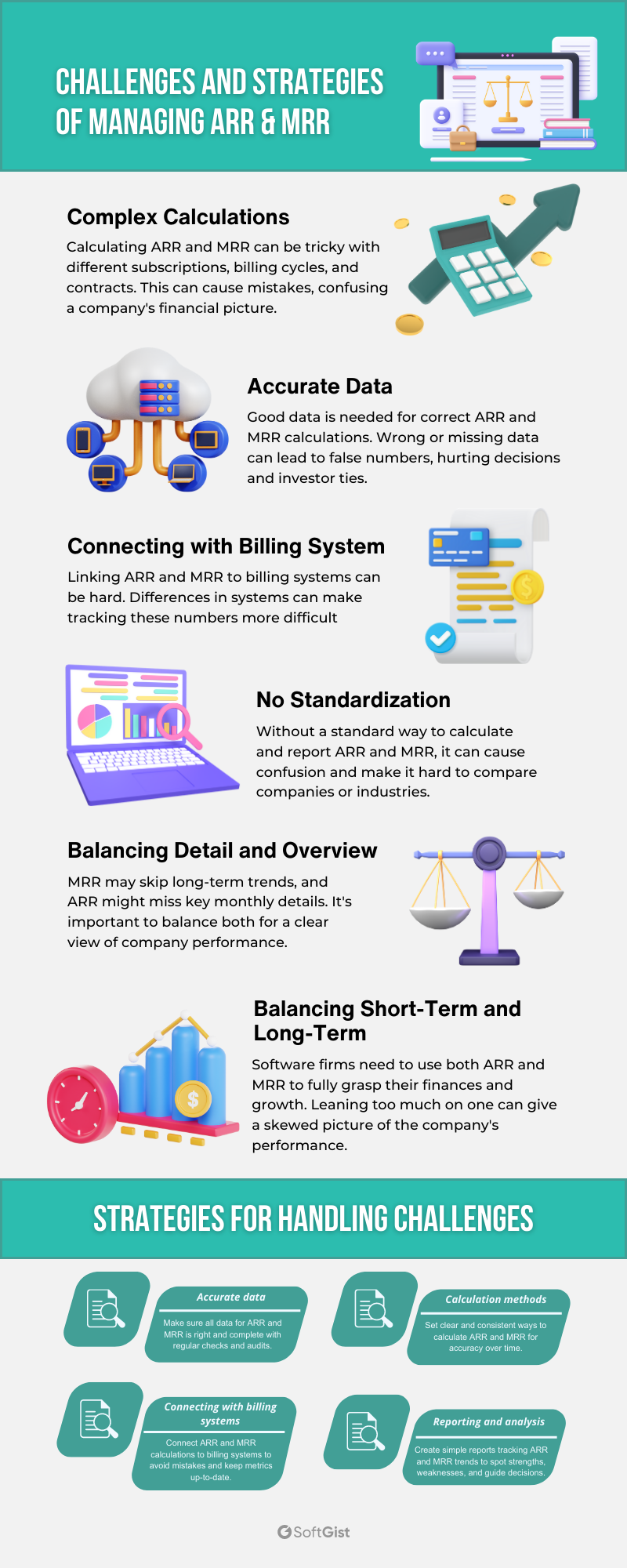

Complex Calculations

Calculating ARR and MRR can be complicated, especially when dealing with different subscription plans, billing cycles, and contract lengths. This complexity can lead to calculation mistakes or inconsistencies, distorting understanding of a company’s money situation.

Accurate Data

Having accurate data is key for reliable ARR and MRR calculations. Incorrect or incomplete data can lead to misleading revenue figures, which can badly impact strategic decision-making and relations with investors.

Connecting with Billing Systems

Linking ARR and MRR calculations with current billing systems can be a tough task. Different systems may have varying compatibility and functions, making accurately tracking these metrics more difficult.

No Standardization

There is no universally accepted standard for calculating and reporting ARR and MRR. This lack of standardization can cause confusion and misinterpretation of these metrics, making comparing performance across companies or industries harder.

Balancing Detail and Overview

While MRR provides a granular view of monthly revenue trends, it may not show long-term trends or be as useful for predicting long-term growth. In contrast, ARR’s focus on yearly performance can hide valuable insights into monthly revenue trends. Striking a balance between these two views is key to fully grasping a company’s performance.

Balancing Short-Term and Long-Term

Software companies need to balance using ARR and MRR to fully understand their money health and growth potential. Overly relying on one metric may lead to an incomplete or skewed view of the company’s performance.

Managing these challenges requires a thoughtful approach that focuses on:

- Accurate data: Ensure all data used to calculate ARR and MRR is correct and complete. This may involve implementing data checks and regular audits.

- Calculation methods: Establish clear and consistent calculation methods for ARR and MRR. This will ensure these metrics are calculated precisely and consistently over time.

- Connecting with billing systems: Link ARR and MRR calculations with current billing systems to avoid errors and inconsistencies. This will keep these metrics updated in real-time.

- Reporting and analysis: Develop clear and concise reports that track ARR and MRR trends over time. This will identify strengths and weaknesses and inform business decisions.

By addressing these challenges, companies can ensure ARR and MRR are used effectively to track and manage their money health and growth potential.

Final Thoughts

For SaaS businesses, recurring revenue is the key that unlocks sustainable success. ARR and MRR help decode these crucial income streams.

Managing these metrics takes work. But the payoff is immense: enhanced planning, valuation, cash flow, loyalty, and reach.

Get the formula right by prioritizing data accuracy, optimizing calculations, and balancing perspectives. Master ARR and MRR to reveal your financial truths.

These numbers provide the complete picture needed to chart the optimal path forward. With their power, SaaS leaders can steer their businesses to new heights.

Wise SaaS captains know recurring revenue holds a lasting competitive edge. So unlock its full potential, and let ARR and MRR be your guiding stars.

Share This Post

Alex Powell

Alex Powell is a senior tech and business media writer with a passion for breaking down complex tech topics into easy-to-understand information. He holds a degree in Business Administration and a master's in Journalism. When he's not writing, Alex enjoys hiking and reading books.

Allow cookies

This website uses cookies to enhance the user experience and for essential analytics purposes. By continuing to use the site, you agree to our use of cookies.