GiniMachine

A no-code AI decision-making software for predictive modeling and business insights

No-code AI decision-making software

Build predictive models and gain actionable business insights

Improve credit scoring, collection, and analytics

Pricing:

Features:

Categories:

#Development & CodeWhat is GiniMachine

GiniMachine is a no-code AI decision-making software that allows users to build predictive models and gain actionable business insights. It leverages AI algorithms to automate and streamline the decision-making process, reducing risks and improving credit portfolio management. The platform also offers features such as credit scoring, collection scoring, and fast credit department audits, helping businesses make informed decisions and optimize their operations.

Key Features of GiniMachine

- No-Code AI Predictive Modeling: Build a predictive model in just a few clicks and receive actionable business insights without the need for coding.

- Automated Decision-Making Platform: Leverage AI to replace antiquated spreadsheets and static data visualization, enabling forward-looking strategic action plans.

- Credit Risk Management: Reduce risks by up to 45% and improve your credit portfolio through advanced AI-driven decisioning processes.

- Credit Scoring: Employ AI underwriting decision software to extend loans to thin-file borrowers, balancing profit maximization with risk management.

- Collection Scoring: Prioritize debtors with high repayment potential and utilize effective collection tools to boost productivity and reduce wasted efforts on non-performing debts.

- Fast and Free Credit Department Audit: Identify biases and human errors in your credit department with a comprehensive, instantly available guide.

- Data Insights: Reveal the value of your data to predict churn, retain customers, and optimize business decisions.

- Predictive Analytics: Process terabytes of historical data to build, validate, and deploy predictive models in minutes, enhancing business forecasting accuracy.

- Debt Collection Agencies: Maximize debt recovery efficiency using AI-powered strategies tailored to streamline workflows and optimize resource allocation.

- Alternative Lending: Score credit applications utilizing diverse data sources like rental payments and public records, automating pre-approval systems and fine-tuning portfolio risks.

- Industry-Specific Solutions: Select your industry to explore tailored advanced features of GiniMachine for balanced decision-making across various business types.

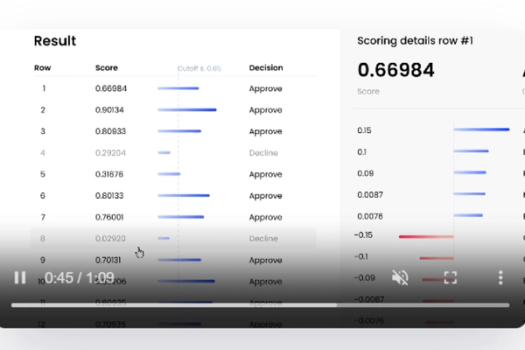

- Building a Model: Achieve precision by analyzing 1000 raw records to uncover impactful factors leading to business outcomes.

- Validating Models: Ensure suitability and accuracy of predictive models through self-assessment within seconds.

- Deployment: Upload your latest data to decode variable influences and predict the most success-driving decisions.

- Case Studies: Explore in-depth examples demonstrating the practical applications and benefits of GiniMachine’s AI solutions in real-life scenarios.

- Partnerships and Academia: Engage with academic and business partners to further leverage the potential of AI decisioning within various sectors.

GiniMachine

A no-code AI decision-making software for predictive modeling and business insights

Key Features

Links

Visit GiniMachineProduct Embed

Subscribe to our Newsletter

Get the latest updates directly to your inbox.

Share This Tool

Related Tools

Allow cookies

This website uses cookies to enhance the user experience and for essential analytics purposes. By continuing to use the site, you agree to our use of cookies.