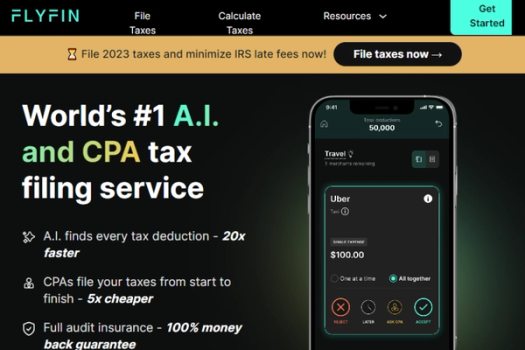

FlyFin

AI-driven tax service with CPA support for freelancers and businesses

AI scans expenses for tax deductions

CPAs handle federal and state tax filing

Full audit insurance and 100% money-back guarantee.

Pricing:

Categories:

#FinanceWhat is FlyFin

FlyFin is an AI-powered tax service designed for freelancers, self-employed individuals, and business owners. It uses AI to scan expenses and identify tax deductions, significantly reducing the user's workload, while CPAs handle the preparation and filing of federal and state tax returns. FlyFin promises faster, cheaper, and more accurate tax services, offering full audit insurance and a money-back guarantee.

Key Features of FlyFin

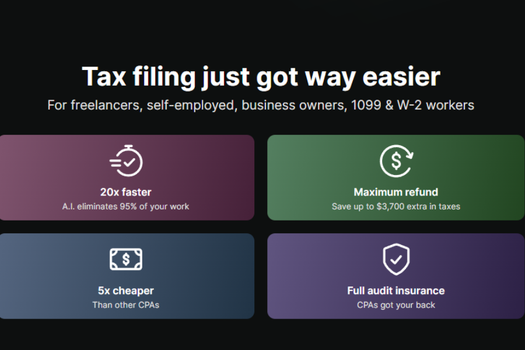

- A.I.-Powered Tax Deductions: Find every applicable tax deduction 20x faster with FlyFin's advanced A.I. technology, covering over 200+ deduction categories.

- CPA-Assisted Tax Filing: Dedicated CPAs handle your tax preparation and filing from start to finish, offering a cost-effective service that is 5x cheaper than traditional options.

- Comprehensive Audit Insurance: Enjoy peace of mind with full audit insurance and a 100% money-back guarantee.

- Versatile User Base: Ideal for freelancers, self-employed individuals, business owners, 1099 workers, and even W-2 workers.

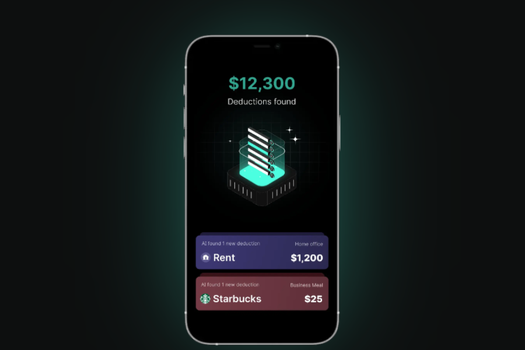

- Expense Scanning: Connect your expense accounts to let FlyFin's A.I. scan and eliminate 95% of the manual work by identifying write-offs.

- Tax Document Upload: Complete your tax profile and quickly upload necessary documents in just 2 minutes for a customized list reviewed by CPAs.

- Quarterly Tax Calculator: Accurately estimate your quarterly tax payments based on deductions and income, with free CPA consultations for quarterly tax preparations.

- Annual 1040 Tax Filing: Ensure precision and compliance with an expert CPA review of your federal and state tax returns before filing.

- Unlimited CPA Consultations: Ask unlimited tax-related questions to CPAs via the app or schedule Zoom calls for personalized advice.

- Financial Tracking: A.I. monthly financial tracker automatically manages your finances, enhancing your overall financial planning.

- Secure Financial Integration: Supports 2,000+ financial institutions with bank-level security measures for linking expense accounts.

- Maximum Refund Assurance: FlyFin guarantees you to save up to $3,700 extra in taxes, ensuring the maximum possible refund.

- Exportable Tax Summary: Easily export your tax summary in Excel format for IRS Form 1040 if you prefer to file through another CPA.

- Privacy and Security: Adheres to the California Consumer Privacy Act, ensuring the protection of your personal data through bank-level security.

FlyFin

AI-driven tax service with CPA support for freelancers and businesses

Key Features

Links

Visit FlyFinProduct Embed

Subscribe to our Newsletter

Get the latest updates directly to your inbox.

Share This Tool

Related Tools

Allow cookies

This website uses cookies to enhance the user experience and for essential analytics purposes. By continuing to use the site, you agree to our use of cookies.