SaaS CAC (Customer Acquisition Cost): A Complete Guide

Updated May 28, 2024

Published July 29, 2023

What is the true cost of winning a new customer for your SaaS business? Understanding your customer acquisition cost (CAC) is key. CAC is a critical metric that measures your spending to acquire each new customer. Tracking CAC provides vital insights to guide marketing decisions, evaluate sales, and inform growth plans.

This article explains how to calculate CAC, avoid common mistakes, and use proven strategies to lower it. Reducing CAC boosts the profitability of your growth. With the right CAC analysis and optimizations, you can acquire new customers sustainably.

What is SaaS CAC?

Customer acquisition cost (CAC) is a vital metric for SaaS businesses to measure the cost of acquiring new customers. There are two primary methods to calculate CAC:

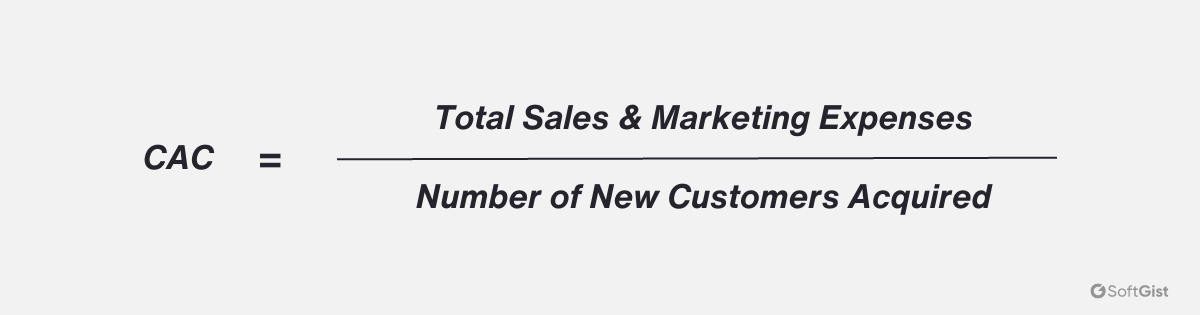

CAC is calculated by taking the total sales and marketing expenses incurred over a period and dividing by the number of new customers acquired in that same period.

The formula for CAC is:

This provides the average cost per customer across all marketing channels and activities.

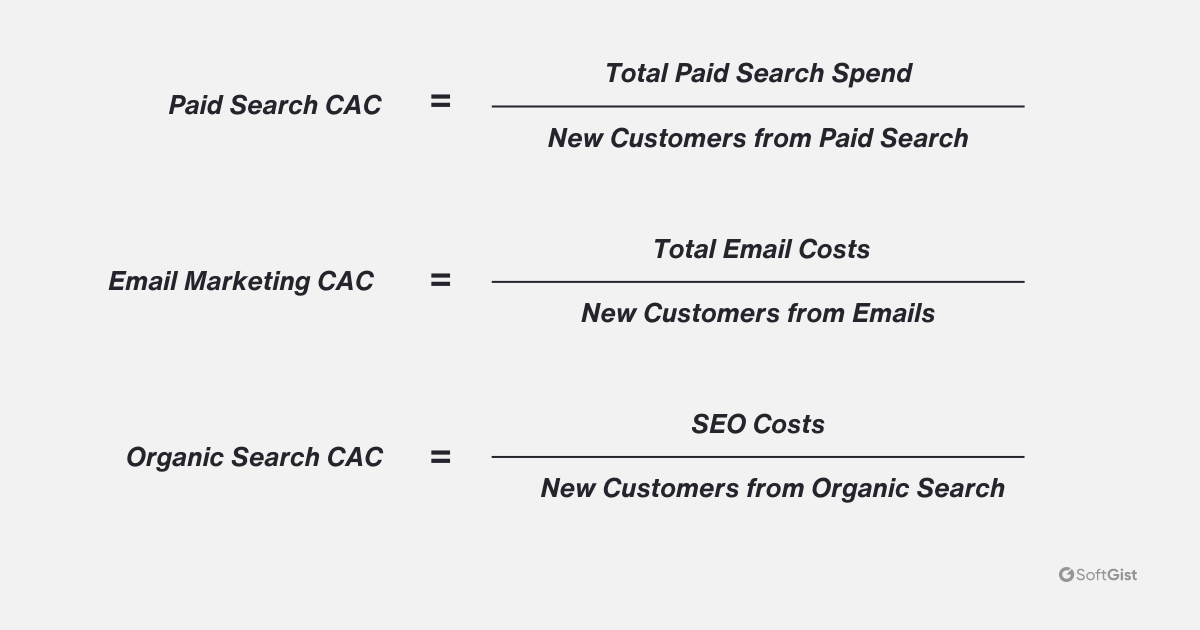

While overall CAC gives a high-level cost view, calculating CAC for each marketing channel enables more precise optimization. To determine CAC for a channel, isolate the sales and marketing costs spent on that channel over a period and divide it by the number of customers acquired through that channel in the same period.

For example:

Analyzing CAC for each channel has several benefits:

- Identify the most cost-efficient customer acquisition channels to prioritize and direct more budget towards.

- Find high CAC channels that may need optimization of targeting, creatives, or tactics to improve performance.

- Forecast required channel budgets based on expected new customer targets and the CAC benchmark for each channel.

- Track channel CAC over time to identify trends and changing channel efficiency.

However, channel-specific CAC has limitations. It can sometimes oversimplify multi-channel attribution if there are synergies across channels. Holistic assessment using both overall aggregated CAC and detailed channel CAC is optimal.

Breaking down CAC by marketing channel provides actionable granular insights into the customer acquisition process and helps optimize strategies and resources. But it should complement the high-level view from aggregated CAC.

Importance of Tracking SaaS CAC

Evaluate Marketing Efficiency

CAC shows how much you spend to get each new customer. A lower CAC means your marketing is more effective for the money invested. Regularly checking CAC and comparing it to competitors highlights areas to optimize marketing activities and improve performance.

Guide Marketing Spending

Breaking down CAC by marketing channel reveals which avenues are most cost-efficient for acquiring customers. This allows for shifting the budget toward profitable channels. Analyzing channel costs also enables refining strategies to reduce CAC.

Assess Profitability

Compare CAC to customer lifetime value to see if acquiring customers is profitable. If lifetime value exceeds CAC, then customer acquisition generates a positive return. Tracking this ratio ensures growth plans maintain profitability.

Inform Growth Plans

Knowing your typical CAC allows you to estimate the sales and marketing budget needed to achieve growth targets for adding new customers. Factoring CAC into growth projections ensures your spending plans align with and support your specific customer acquisition goals. Planning growth rooted in your real CAC data provides a realistic, sustainable path.

Evaluate Sales Performance

CAC enables objective sales team assessment. Comparing reps on deals closed versus CAC highlights top talents and shows who need coaching to improve acquisition skills. CAC targets drive cost-efficient customer acquisition.

Identify Issues

Sharp CAC rises indicate potential problems that need investigation. Analyze customer behavior changes and conversion rate drop-offs to diagnose underlying issues like product-market fit, poor targeting, or sales weaknesses. Act quickly to keep acquisition costs under control.

Common Mistakes in Calculating CAC

Not Including All Relevant Costs

A major mistake SaaS companies make is failing to account for all the expenses related to acquiring customers in their CAC calculations. This includes not just direct marketing costs like advertisements and promotions but also indirect costs like sales team salaries, commissions, customer support expenses, software costs, and overhead expenses. Ignoring these indirect costs leads to underrepresenting the full investment required to acquire customers, resulting in lower and inaccurate CAC values.

Ignoring Time Lags

There is usually a time lag between when marketing spend happens and when new customers are acquired. For example, the costs of a campaign may be incurred in Q1, but the acquired customers only show up in Q2. Not factoring in this lag can inaccurately match costs and customers across time periods, distorting the CAC value. SaaS companies should carefully align timing to attribute costs to the period in which corresponding customers are gained.

Assuming CAC is Constant

Since marketing tactics, competitive promotions, and macroeconomic conditions change frequently, CAC fluctuates over time. However, some SaaS companies wrongly assume CAC remains constant once calculated for a period and then use that stagnant CAC estimate for projections. This can lead to unrealistic targets and budgets. Regularly updating CAC is vital.

Not Comparing CAC to Customer Lifetime Value

While CAC reveals the customer acquisition costs, it must be analyzed relative to the lifetime value of acquired customers to determine profitability. A high CAC may be acceptable if the lifetime value is also high, but comparing the two metrics is essential. Ignoring lifetime value can result in acquiring unprofitable customers.

Not Segmenting CAC

Calculating one CAC for all customers obscures significant differences in acquiring customers across segments, marketing channels, geographies, etc. A more segmented CAC analysis illuminates where acquisition is more or less efficient, enabling optimization.

Not Factoring in Customer Churn Rate

The rate that customers stop doing business, called churn rate, can really impact cost per new customer. If a company loses customers quickly after getting them, it makes the cost per new customer seem inflated. Companies should try to lower the churn rate to keep the cost per new customer healthy.

Ignoring the Impact of Referrals

Getting customer referrals can lower the cost of acquiring a lot since it requires less marketing money. If a company has good referrals but doesn’t track that separately, it could skew the cost calculations. It’s important to track referrals and their impact independently to see their true value.

Not Adjusting for Seasonality

Many companies get more new customers during certain seasons. For example, a retail store likely gets more customers over the holidays. If companies don’t adjust cost calculations for seasonal swings, they could misunderstand the numbers. It’s key to factor in seasonal trends when looking at cost per new customer.

Not Considering the Full Sales Cycle

In some industries, especially B2B, the sales cycle can be long and complex. If a company calculates cost over a period that doesn’t cover the full sales cycle, it could be inaccurate. It’s important to factor in the sales cycle length and complexity when calculating the cost per new customer.

SaaS CAC and Lifetime Value (LTV)

Customer acquisition cost (CAC) and customer lifetime value (LTV) are two vital metrics for evaluating a company’s customer economics.

CAC represents the full cost of acquiring a new customer over a period. This includes marketing, sales, and other costs for getting new customer sign-ups and purchases. It’s calculated by totaling these costs and dividing them by the number of new customers gained.

LTV calculates how much revenue a single customer will likely generate over their entire relationship with a company. It factors in metrics like average purchase value, purchase frequency, retention time, and predicted lifespan. In essence, LTV measures expected total profitability per customer.

The LTV:CAC ratio compares these two metrics. It’s calculated by simply dividing lifetime value by acquisition cost:

LTV:CAC Ratio = Lifetime Value / Customer Acquisition Cost

This ratio shows the payback from investing to get customers. A higher number indicates a greater return on acquisition spending.

The optimal LTV:CAC ratio depends on factors like industry and business model. However, there are some general guidelines. A ratio of 3 or higher is typically good, indicating the lifetime value is at least 3 times higher than the acquisition cost. A ratio below 1 means losing money on each customer acquired. A ratio between 1 and 3 signals potential for improvements in acquisition strategy to increase profitability.

The key point is that lifetime revenue from customers should sufficiently exceed the costs of acquiring them for a sustainable, profitable business model. The higher the ratio, the better the return on acquisition investment.

Optimizing this ratio involves:

- Focusing on high-value customer segments

- Reducing acquisition costs through optimized marketing

- Improving retention to maximize lifetime value

- Testing campaigns to increase effectiveness

Monitoring LTV:CAC enables ensuring profitable growth. Comparing the ratio to benchmarks helps identify improvement opportunities.

Strategies to Optimize SaaS CAC

Reducing CAC is crucial for companies to ensure a sustainable, profitable business model. A high CAC indicates inefficiencies in acquiring customers that eat into margins over the customer’s lifetime. Here are some common strategies to optimize CAC:

Optimize Your Sales Funnel

Conduct an in-depth analysis of your sales funnel, using data and analytics to identify sticking points. Look for areas with high drop-off rates or slow lead velocity. Survey customers who didn’t convert to understand pain points. Experiment with removing friction elements like excessive form fields. Streamline lead qualification criteria to filter out low-quality prospects earlier. Automate handoffs between sales stages to accelerate deals. Refine onboarding messaging to boost activations. A smoother, faster funnel improves conversion rates and lowers CAC.

Boost Customer Retention

Don’t just focus on customer acquisition – work equally hard to retain happy customers longer. Analyze churn data to find why customers leave and proactively address those causes. Survey customers frequently to monitor satisfaction. Develop educational content and training to increase product usage and value. Create VIP loyalty programs with perks and rewards for your best customers. Seek regular feedback to improve the customer experience. Guide customers to upgraded plans when appropriate. Retaining customers longer amortizes your acquisition costs over a longer lifetime.

Target High-Value Customers

Build detailed buyer personas to identify your most valuable customer segments with the highest potential lifetime value. Then tailor your messaging, offers, and pricing specifically to resonate with those personas. Focus advertising and promotions on channels those segments frequent. Equip the sales team to have relevant, meaningful conversations that move high-value prospects down the funnel. Avoid wasting your budget trying to attract mass market or low-value customers. Targeting the right customers improves conversion rates and keeps CAC low.

Track CAC Against Other Metrics

While CAC is important, also track it against related metrics like the Magic Number, customer lifetime value (LTV), conversion rates, and churn rate. Understanding CAC in the context of these other metrics gives a more complete picture and helps make smarter marketing and sales resource allocation decisions. For example, if LTV is high, but CAC is also rising, you may want to double down on retention efforts rather than new customer acquisition.

Leverage Automation and Analytics

Marketing automation tools can help nurture leads with targeted content and messaging automatically to improve conversion rates. CRM software centralizes prospect data to enable sales teams to focus on the highest-value opportunities. Web analytics provides insights to optimize landing pages and campaigns for lower CAC. Used together, these technologies can streamline repetitive tasks, allowing sales and marketing staff to spend time on high-impact activities to reduce CAC.

Test and Refine Your Funnel

Use A/B and multivariate testing to continuously experiment with and optimize each element of your sales funnel – ads, landing pages, offers, etc. Testing allows you to iterate and refine parts of the funnel that may be underperforming to improve conversions. For example, testing pricing page layouts may show that a different structure converts 20% more visitors. Fixing small issues compounds over time into significant CAC reductions.

Implement Retargeting and Affiliate Strategies

Retargeting keeps your brand visible to potential customers as they move through the sales funnel, bringing them back to complete a purchase. Affiliate programs incentivize partners to generate new sales for you, but you only pay them on a completed sale. This way, you don’t waste ad spending on cold leads. Combining these strategies allows you to double down on warmer leads in a cost-efficient way.

Final Thoughts

Calculating CAC consistently across your organization is crucial for alignment. Ensure everyone uses the same CAC definition and methodology. Break down CAC by product, channel, and geography to spur actions. Compare your CAC carefully only against true apples-to-apples benchmarks. Miscalculations or misuse of CAC metrics can lead teams in the wrong direction. With executive leadership oversight, you can establish organization-wide CAC fluency.

This understanding enables stakeholders at all levels to make data-driven decisions using this vital SaaS metric. Acquiring customers profitably enables sustainable growth, so keep refining your strategy. With a consistent focus on optimizing CAC, you can build a profitable, efficient customer acquisition machine.

Frequently Asked Questions

Share This Post

Ada Rivers

Ada Rivers is a senior writer and marketer with a Master’s in Global Marketing. She enjoys helping businesses reach their audience. In her free time, she likes hiking, cooking, and practicing yoga.

Allow cookies

This website uses cookies to enhance the user experience and for essential analytics purposes. By continuing to use the site, you agree to our use of cookies.